Energy Affordability

Electricity remains a relatively small share of household spending, and electric rates are increasing at a slower rate than other big-ticket items. While Vermont households spend a larger share of their income on electricity, heating, and transportation fuels than the national average, 80% of this spending is for heating and transportation.

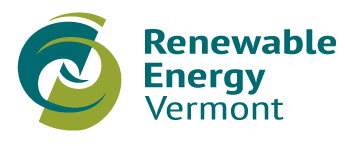

In the Northeast, 80% of household spending goes towards housing, transportation, food, and healthcare

- Electricity represents just 2% of household spending.

- In Vermont, housing, transportation, food, and healthcare spending are all increasing more quickly than electric rates.

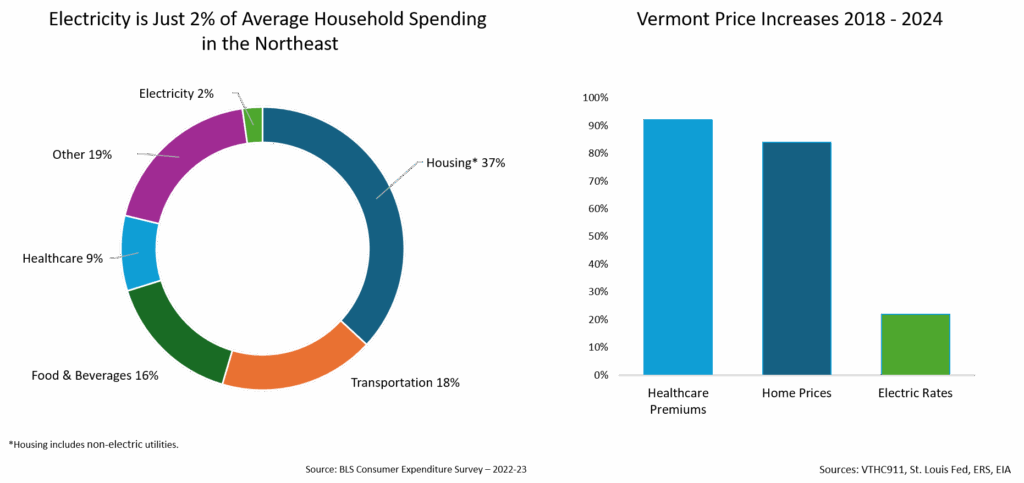

Vermont’s energy spending in context

- 80% of residential energy spending is for transportation and heating, reflecting Vermont’s cold climate and rural development patterns.

- In many cases, electrification reduces households’ total energy burden, with Efficiency Vermont estimating households can reduce their energy costs by 9.8 – 11.8% by switching to a hybrid electric or all-electric vehicle.

Why are Electric Rates Increasing?

In New England, electricity costs increased by 13% between 2023 and 2024. The primary causes of this cost increase were:

- A weather-related decrease in hydropower imported from Quebec

- Increasing RGGI compliance costs for fossil fuel generators, and

- Increasing transmission costs.

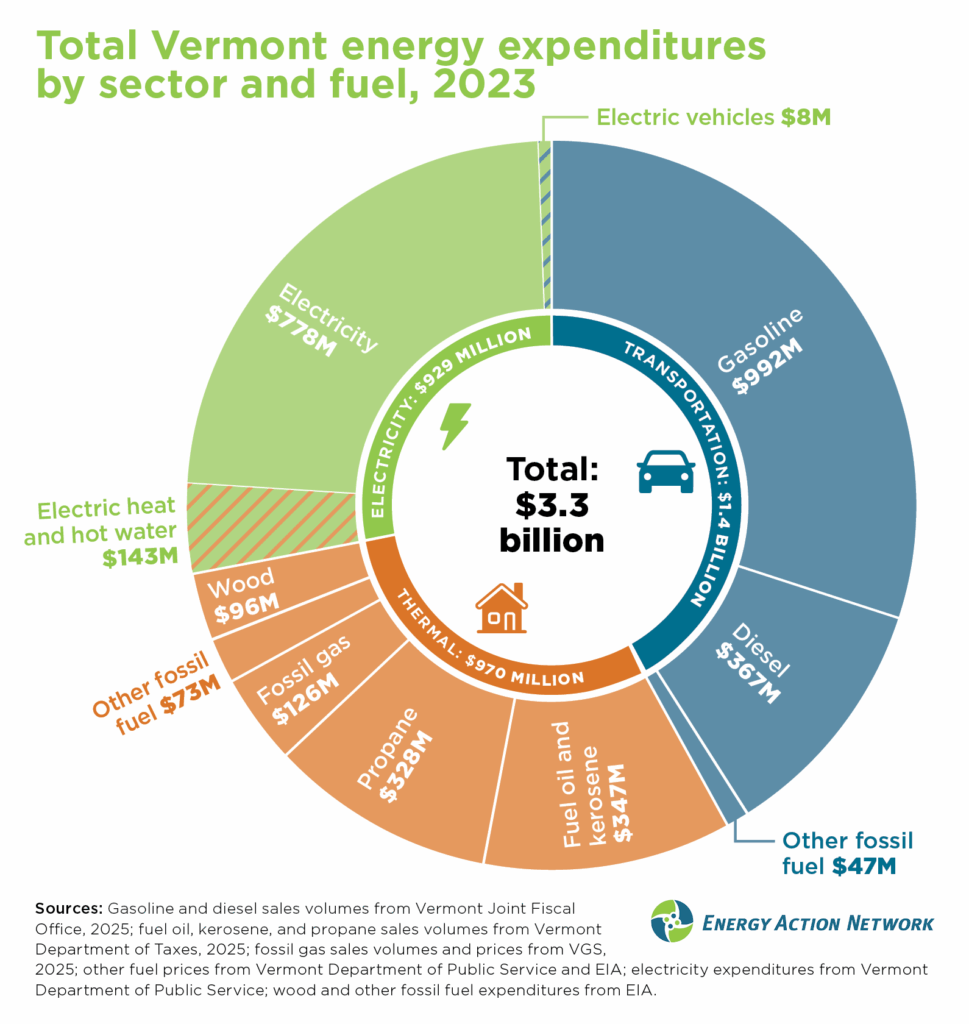

Electricity Prices in Vermont and New England

Vermont’s electric rates are the lowest in New England, and our rates have largely tracked the rate of inflation over the last decade. Over the same time period, electric rates in the rest of New England have increased more than twice as fast. Vermont’s success in keeping rates down can be attributed to the past policy decisions to:

- Prevent utility-sector deregulation

- Prioritize long-term renewable energy contracts

Renewable energy facilities like wind, solar, and hydro are uniquely well-suited for long-term contracts since they do not have to plan for highly uncertain fuel costs. In contrast, contracts with natural gas generators tend to be much shorter because the extreme volatility in fuel prices adds considerable uncertainty to operating costs even a few years into the future. Our utilities’ long-term renewable energy contracts have consistently proven their value to Vermont ratepayers.

Renewable energy facilities like wind, solar, and hydro are uniquely well-suited for long-term contracts since they do not have to plan for highly uncertain fuel costs. In contrast, contracts with natural gas generators tend to be much shorter because the extreme volatility in fuel prices adds considerable uncertainty to operating costs even a few years into the future. Our utilities’ long-term renewable energy contracts have consistently proven their value to Vermont ratepayers.

How Can We Mitigate Rising Rates?

The best way to keep rates down as electricity demand increases is to bring new generating and storage capacity online as quickly as possible. Wind and solar are our country’s cleanest and cheapest sources of power, and, along with storage, the resources that we can build most quickly to meet rising electricity demand.

Invest in Solar & Storage

The cost of the electricity is at its highest during periods of peak demand when we are forced to use power from the region’s most expensive (and generally dirtiest) power plants. Solar and storage can reduce our reliance on these plants.

In 2025, New England’s peak demand occurred on June 24th, in the midst of a prolonged heatwave. Fortunately, solar and storage significantly reduced ratepayer costs. The Acadia Center estimated that behind-the-meter solar, like the systems people have on their rooftops, saved all ratepayers $19 million on the 24th alone and concluded that “more behind-the-meter solar paired with storage” could have helped avoid price spikes that occurred later that evening.

In Vermont, Green Mountain Power reported that utilization of the combination of behind-the-meter solar, residential batteries, and utility-scale battery storage resulted in approximately $3 million in savings for its customers.

Invest in Wind

Wind and solar power are highly complementary because they power production peaks at different times of the day and year. Offshore wind output is concentrated at times when energy is most expensive and, as a result, lowers the wholesale price of energy significantly. Daymark Energy found that just 3.5 GW of offshore wind would have saved New England ratepayers $400 million last winter, simply by virtue of reducing wholesale prices during these hours.

Energy Affordability Resources

Natural Gas: Too Slow, Too Expensive

In addition to its adverse impacts on human health and the climate, the backlog for natural gas turbines is so long that it would be all but impossible to add significant new natural gas generation to meet rising demand before the mid-2030s. New natural gas projects initiated today would be unlikely to even start construction before 2030.

Wind, solar, and storage offer the fastest and lowest-cost path for adding new capacity to the grid. NextEra Energy, which owns and operates the largest fleet of natural gas plants in the U.S., projects that new natural gas plants will have record-high costs and will not be available until 2032.

“We need a bridge to get ourselves to 2032 when that gas shows up,” [NextEra CEO John] Ketchum said. “And when that gas shows up, it’s going to be three times more expensive than it’s ever been. If we take renewables off the table, we are going to have a real power shortage problem in this country.” – Reuters.

The cost of new natural gas facilities has tripled in the last three years alone, and equipment shortages are so extreme that two Kentucky utilities recently spent $25 million simply to reserve a spot in the manufacturing queue for two natural gas plants that will cost close to $3 billion when finally constructed. Combined with the historic volatility of natural gas prices, it makes new natural gas a very risky investment from a cost perspective.

“We built our last gas-fired facility in 2022, at $785/kW. If we wanted to build that same gas-fired combined cycle unit today…$2,400/kW,” he said. “The cost of gas-fired generation has gone up three-fold.” – NextEra Energy CEO John Ketchum in Gas Outlook.

At $2,400 kW, natural gas plants exceed the cost of onshore wind or solar facilities even before considering the cost of fuel!

Take Action

Contact Us

13 Baldwin Street, Suite 205

Montpelier, VT 05602

802.229.0099

admin@revermont.org