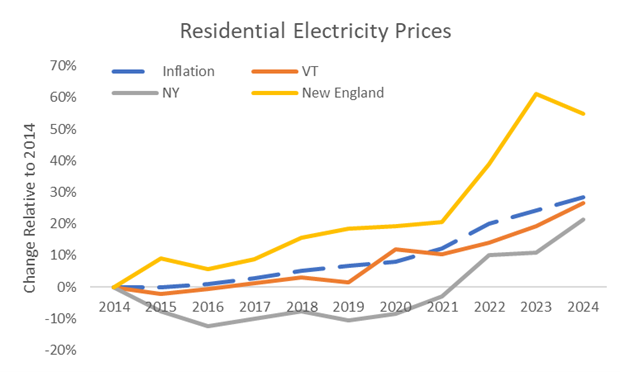

Electric rate increases have been generating headlines recently. Since 2022, rates have increased significantly more quickly than inflation across much of the country. New England has experienced some of the most dramatic price increases over this period, but Vermont’s rate increases have generally been close to the rate of inflation. Nationally, rates are expected to continue to increase more quickly than inflation in the near term.

Key drivers of rate increases include:

- Increasing demand: Electricity consumption is growing at the fastest rate since the 1990s. This is attributable to increased electrification and new demand for data centers.

- Rising fuel prices: Natural gas prices are a major determinant of electricity prices. The average price for natural gas in 2024 was $2.28/thousand cubic feet, and the EIA forecasts that it will increase to $3.81 in 2025 and $4.58 in 2026. Continued expansion of LNG export capacity could contribute to significantly higher natural gas prices going forward.

- The Trump budget reconciliation bill: The rapid phase-out of tax credits for wind and solar projects (the two generating technologies that can be built most rapidly) is projected to increase electricity costs significantly, especially in states that lack policies to promote continued renewable development.

- Slow capacity expansion: Backlogged interconnection queues are resulting in wait times of 5 to more than 9 years before projects can get permission to connect to the grid, slowing our capacity to bring needed generating capacity online. This affects both renewable generation and traditional fossil generators, though wind, solar, and battery storage make up 95% of the total proposed capacity waiting for interconnection approval. In addition, supply chain challenges are causing a 5-7 year wait time for natural gas turbines, making it difficult, if not impossible, to dramatically scale up natural gas generating capacity beyond what before the end of the decade.

- Climate change: Many utilities cite infrastructure investments to mitigate extreme weather and natural disasters as a cost driver. In Vermont, multiple Vermont utilities, including GMP, WEC, and VEC, have reported record-high storm recovery costs in the last three years.

How does New England compare to the rest of the country?

New England has some of the highest electric rates in the country. Between 2022 and 2025, rates in New England increased by 19%, the same rate as in mid Atlantic census division and more slowly than in the Pacific (26%) but more quickly than the US average. New England’s high rates are largely attributable to high natural gas prices in the region due to natural gas pipeline constraints. Regions with higher wind and solar penetration also show a lower correlation between natural gas prices and electricity prices.

New England also has some of the highest transmission costs in the country. Notably, while transmission expansions in other parts of the country have been geared towards connecting more renewable resources, ISO-NE transmission expansion has been driven by reliability concerns. Fortunately, one side benefit of these reliability investments is that the ISO is well-positioned to add additional renewable generating capacity.

How does Vermont compare?

Over the past decade, residential electricity prices in Vermont have increased significantly more slowly than in New England as a whole.

The Public Service Department (PSD) projects rates in Vermont to increase by approximately 25% by 2030, or about 4.6% per year, ahead of the current inflation of 3% per year. Today, the average electric bill in Vermont is close to $130 a month. Assuming rates were to increase at the rate of inflation, bills would increase by $20/month in 2030. If rates were instead to increase at 4.6% year, this would increase the average monthly bill by an additional $12. Nationally, ICF forecasts rate increases of between 15% and 40% over that same time period, meaning that the PSD forecast is slightly below the midpoint of the ICF forecast range.

Looking at recent tariff filings by Vermont utilities, labor costs, insurance, storm recovery, and regional transmission costs (again, New England has among the highest transmission costs in the country) are all cited as drivers of rate increases.